The world of e-wallet is growing exponentially. According to a study, the market of mobile wallets is forecasted to reach $255 billion by 2025 at a CAGR of 15.2% during 2020-2025.

With such tremendous growth, companies have identified the bright future of e-wallet mobile apps and have started investing a huge sum in e-wallet mobile app Development companies.

Ever since mobile wallet apps entered our lives, the hustle of keeping cash and the compulsion to make cash payments have become old school. When plastic cards replaced cash payment, things became easier, but with e-wallet mobile apps, things became even better, as now customers can make payments and transactions with the help of their mobile devices.

The surge in the eCommerce industry and the demand for online payment have made mobile wallet applications a great success. In the recent time of pandemic e-wallet, mobile apps proved themselves quite helpful.

The Major Types of Mobile E-Wallet Applications

Millennials and Gen Z are techno-savvy, and they want every task to be done at their fingertips, so why not make payments. The youth of the present epoch want everything to be completed within a jiffy, and making payment in cash and waiting for a change in exchange only slows things down.

Keeping the comfort of customers on the priority list, many businesses have already started investing a huge amount of money to develop e-wallet mobile applications.

Before we move ahead and discuss things ahead, let’s understand the different types of eWallet mobile applications.

Closed eWallets

These types of mobile wallet apps are exclusive ones that allow making the payment only for the purchase of products on the app. One of the best examples of the closed eWallet mobile apps is Walmart Pay.

The closed e-wallets applications can only be used for a particular app, and the customer cannot make payment for other products.

Open e-Wallets

Evident to their names, these eWallets are the most commonly used mobile wallet applications that can be installed on iOS and Android devices. One can make multiple transactions through these apps without any hassle. Making payment through these apps is very easy. Mobile wallet apps like Paytm and Google pay fall under the category of Open eWallets mobile applications.

Semi-Closed eWallets

These kinds of applications provide more liberty of payment than closed apps and less than open e-wallet apps. While using these semi-closed e-wallet mobile applications, customers can make payments only at the stores that have signed a deal with an e-wallet company. These apps work on some outlets and not on others.

The Top Mobile Wallet Applications Around The World

- Paypal

- Stripe

- BlueSnap

- WePay

- Payline

- GooglePay

- Adyen

- Authorize.net

- Amazon Pay

- Alipay

- Samsung Pay

- Pay Simple

- Apple Pay

- Payoneer

- 2CheckOut

Different Industries and The Rise of Mobile Wallet Applications

In a recent study, it has been found that the market of mobile wallet applications will excellently grow at a CAGR of 28.2% from USD 1043 bn to 7580 bn in 2027. The increase in the market value of mobile wallet apps tells us how different industries are investing highly in e-wallet apps.

Below are discussed the industries that will depend on the rise of eWallet mobile applications.

Taxi Booking

Gone are the days when you used to wait at the taxi stand to catch a conveyance so that you don’t miss it and reach your targeted location on time.

With the advent of mobile wallet apps, cab booking has become more convenient. The convenience of online payment has bolstered the demand for taxi booking applications. The e-wallet features integrated with the taxi booking mobile app will do everything.

Ticket Booking Apps

Booking tickets for a movie, a railway, or any other service has become so easy ever since mobile wallets have been integrated within the ticket booking mobile apps.

eCommerce Industry

The most common yet the most crucial industry, eCommerce thrives on the success of e-wallet app development. From ordering food to apparel, from medicine to home décor items, eCommerce has made everything within a click away.

With mobile wallet applications, conducting eCommerce activities have become more convenient than ever.

Online Bill Payment

There are some dedicated mobile apps for bill payment, and with mobile wallet integration, things become easier. Clients love mobile wallet applications due to the convenience of bill payments.

On-Demand Food & Grocery Delivery Apps

Online food and grocery delivery apps have made things more convenient and simpler than ever. There is an ease of getting household items at your doorstep, and then comes the ease of making online payments that prevent customers from handling cash transactions.

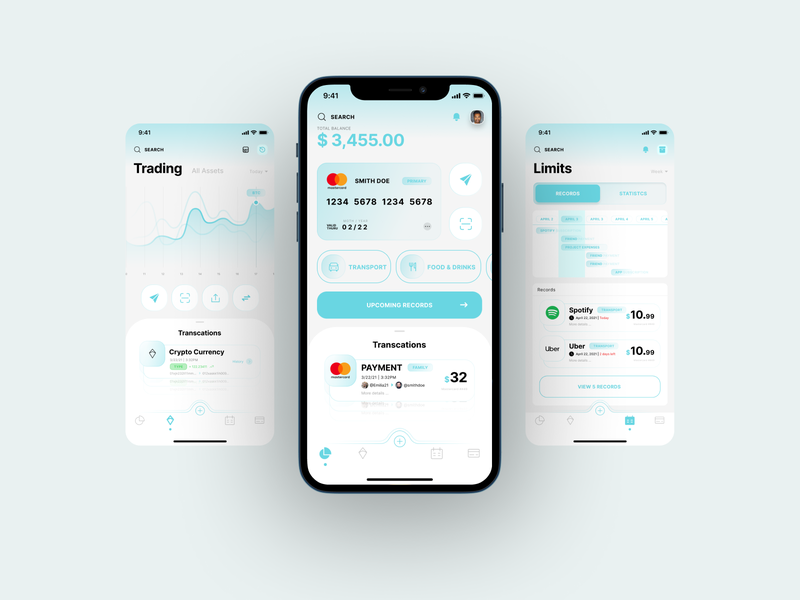

The Main Architecture of An eWallet Mobile Application:-

User Panel

- User registration via social profile or email

- Add amount

- Dedicated user profile

- Pay bills or set autopay

- Check amount balance

- Transfer money

- Budget management tool

- Split bills

- POS integration

- View transaction history

- Send payment requests

- Send an invite & get referral points

- Accept payments

Merchant Panel

- Log in to an interactive dashboard

- Add and manage products

- Manage customers

- Push notifications

- Generate QR code

- Add promotional offers & discounts

- Manage EMI payment options

- Offer loyalty points and rewards

- Manage staff & employees

Admin Panel

- Secure login

- Reporting & auditing

- Manage users

- Users data control

- Real-time analytics

- Revenue management

- Manage users and merchants

- Manage and extend security

- Add new offers

Advance Features:

Push Notification

The app owners can send notifications of all the transactions to the users. It will build belongingness among the users of your app.

Social Login/Signup

It will be easy for users to get into the app through their social media profiles. It will save time and effort and make things more user-friendly.

QR Code

The QR code feature in the e-wallet mobile app enables users to make contactless payments by scanning QR codes through the camera.

Better Management of Personal Expense

The feature helps users to track the expenses done on buying products in a particular period of time. It will give users a better understanding of the money spent.

Loyalty Programs

This feature helps app owners garner greater customer loyalty and satisfaction. App owners can give loyalty points to customers and enable them to spend them in future.

CRM System

Through a CRM integration, you can give your customers the required assistance at any point in time. This will empower users to experience better customer satisfaction.

Real-time Analytics

An app owner can easily and effectively understand the performance of their app through the real-time analytics feature. It provides detailed information on all the transactions.

Virtual Card

The users of the app will get a personalized & unique number that will act as a virtual card to make the payments.

Chatbot Support

The Chatbots will improve the user experience. They can avail themselves of the required help from assisting staff anytime and anywhere.

Technologies Stack

- Nexmo – For SMS, Phone & Voice Verification

- Payment – Braintree, Paypal, Stripe, E-Wallet, E-banking, PayUMoney

- Database – MongoDB, MySQL, HBase, Cassandra, PostgreSQL, MailChimp, Integrations

- Front End – Jquery, Angular, JavaScript, CSS, HTML5, Bootstrap

- Cloud Environment – AWS, Azure, Google Cloud, Salesforce, Cloud Foundry

- Real-Time Analytics – Hadoop, Spark, Big Data, Apache, Flink, Cisco, IBM

- Push Notification – Twilio, Push.IO, Amazon SNS, Urban Airship, Map, AdPushup

- Datastax – For Data Management

- Mandrill – For emails related

- ZBar Bar Code Reader – For scanning QR code

Required Team Structure for EWallet Mobile App Development

Developers

They are the ones who turn an idea into a feasible reality. Developers are responsible for crafting a perfect app with clear features. The technical team includes Android App Developers and iOS App Developers that are headed by skilled and experienced project managers.

Designers

Responsible for the user interface of an app, designers beautify the looks and feel of an app that attracts users. It is important to have UX/UI designers with the right skills that can comprehend the core idea of the mobile wallet application.

Testers

The role of QA experts and testers are imperative. They test the entire app to identify bugs. We can say they are the responsible stakeholders for the success and failure of an app. Once they pass the app, only then it will get deployed.

Factors To Keep In Mind While Developing an eWallet Mobile App

Regulatory Compliance

The e-wallet apps deal with money and transactions, therefore an app owner should comply with the app with rules laid by regulatory authorities. It will mitigate the risks, and streamline fair & transparent transactions.

Fraud Risk

In the apps where monetary transactions take place, there is a possibility of frauds and scams.

Data Security

Make sure that your app should be properly encrypted and does not have any way for a data breach. The smallest leakage could affect the reliability of the mobile wallet application.

What is the price of developing an eWallet Mobile App?

Developing an app like a mobile wallet requires multiple factors. These factors include the technology used, team experience and expertise, platforms, design of an app, size of an app, features to be included, and geographical location, to name a few.

In regions like North America for instance, the price is around $150 per hour, in Europe, it is $130 per hour, and in Australia, charges are around $190 per hour.

Amidst all, India is the most affordable county to build a quality eWallet mobile app. The companies charge $25 -$ 80 per hour. The cost of developing an eWallet Mobile app is around $25,000 to $50,000, and applications like Paytm that are rich in features can cost you up to $100,000 to $150,000.