More than 80% of the world’s population owns a smartphone. It means that much of the population is using one or the other mobile app. In the present time, e-wallet mobile apps demand has surged high.

According to a survey by Juniper Research, the digital wallet users are expected to exceed 4.4 billion USD by the year 2025, which were 2,6 billion in 2020.

In the light of the pandemic, many businesses have digitally transformed themselves, and to keep up with the social distancing norms, they have adopted payment digitization for an easy and rapid payment process.

Still, many businesses are coming online, and they all are embracing the importance of e-wallet app development. In a study, it has been revealed that the total digital payment processed by the end-users in 2020 was whooping 70.3 billion.

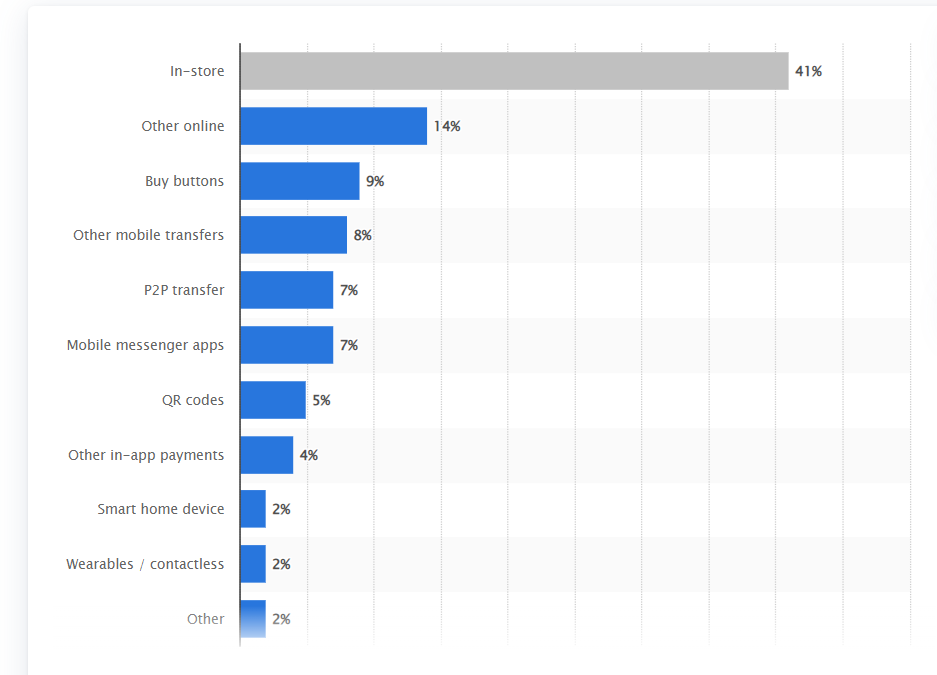

The Most Popular Digital Payment Methods

The graph below showcases the most popular digital payment methods that internet users use across the world. The data is based on the survey done in 2018 by Statista. In the survey, internet users shared about the payment methods which they had used in their last 10 transactions.

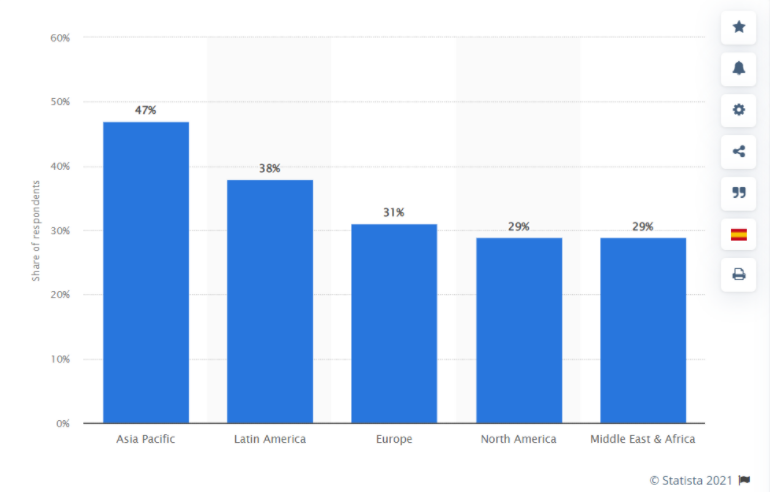

Here’s one more survey was done by Statista, wherein you will see the share of internet users region-wise, across the globe that uses mobile payment services.

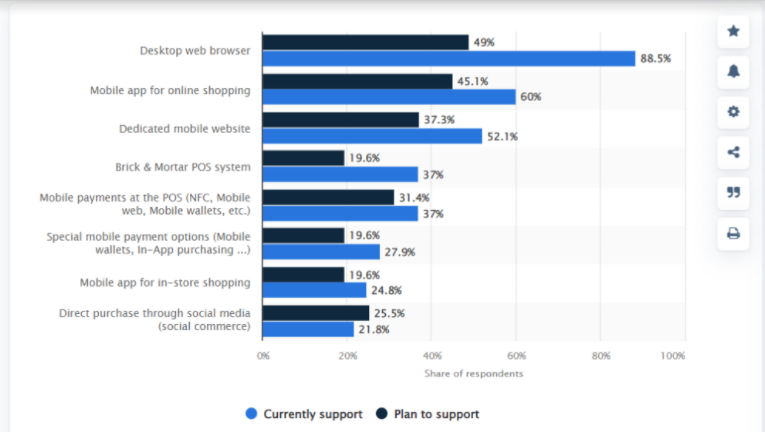

For your better understanding, we bring to you one more survey, wherein you will see the payment channels, which online merchants support around the world. The number of merchants that supports mobile apps for online shopping is 60%, whereas 45.1% of merchants globally are planning to support the e-wallet mobile apps for online shopping.

All the stats, all the numbers, all the surveys indicate the blooming future of the e-wallet app development services.

There are several e-wallet app development companies out there among which you can choose the most suitable one.

Now, as you have understood what the market says about the eWallet mobile apps, its time we understand the reasons to choose eWallet mobile apps.

Why You Should Build a EWallet Mobile App

Ewallet mobile applications are the future of ePayments. Many businesses are embracing the technology into their online business and enjoying the enhanced customer interaction with your business.

Here are some important points that will help you understand, how you can understand, how eWallet mobile app development is beneficial:

Easy Accessibility

When a business embraces eWallet mobile application, they technically empower their customers. With the use of mobile wallet apps, transactions become easy and seamless.

Even people with no technical know-how can easily make payments. Easy accessibility to payment options and easy transactions elevate the user experience and relationship with the brand.

Simple to Transfer Money

Online wallet applications allow users to easily add money in it via multiple ways such as net banking, credit card, debit card, etc.

The app also allows users to store to save the banking details in a highly encrypted environment so that users won’t face the hassle of entering the details every time they make any transaction.

Another important thing is that you can configure your bank with the eWallet application. In this way, you do not have to worry about the insufficient fund in the wallet; you can directly make payment via bank through the eWallet app.

EWallet Mobile Apps are Multi-Purpose

Whether you want to pay your electricity bill or wish to book a ticket for a movie, from postpaid, data card & internet to buying travel tickets and hotel booking, eWallet mobile apps help users in different variety of transactions.

It means that no matter from whichever industry you are. With the help of e-wallet app development services, you can offer a seamless user experience to your customers & harness stronger relationships.

Timely Payment & Quick Transfer

When you go for e-wallet mobile app development, you can also include the feature of autopay. It will enable the mobile wallet to make future bills automatically.

In addition to this, the e-wallet apps have also made sending & receiving money rapid and super easy. It is also another best option to transfer money because no additional or transfers charges are levied on the money transfer.

Another amazing thing about the e-wallet mobile apps is the availability of multiple money-saving features such as discounts, cash backs, offers, cash points, free gifts, etc.

Future Trends in Ewallet App Development

Technology is evolving at a fast pace and impacting our lives in a great way. One of the most important technological innovations is e-wallet mobile app development.

Businesses from different industries are now understanding and embracing mobile wallets and for this, we have brought to you a list of future trends of eWallet mobile app development.

Go through these trends before your hire e-wallet app development company.

Biometric Authentication

Security is the major concern in e-wallet mobile apps. With the advent of biometric authentication, users can secure their financial details stored in the app, especially if they have their phone with someone else.

The biometric authentication can be performed through fingerprints, face print, retinal scan, iris scan, and voice recognition.

Ask your eWallet app development partner to include this trending feature. It will enhance the security of the app and protect users from identity theft.

Usage of QR Codes

QR comes in handy when a user does not want to share his or her phone number registered with the e-wallet app. QR make online transactions super convenient without worrying about sharing phone numbers with strangers.

QR scanning has made the life of people amazingly convenient and simpler. Each QR code is unique. You can send or receive the money using QR codes.

Ask your e-wallet mobile app developer to include it in your app.

Payments via Smart Speakers

The use of Artificial Intelligence in any app has become a trend in the present time. You can also leverage the technology by including smart speakers functionalities within your e-wallet app.

You can use smart speakers and make online purchases, pay bills, order online tickets for movies and transportation, and do everything without touching your phone or tapping over it anywhere.

Just use your voice, give the command, and the rest will be taken care of by the digital wallet app. For more details on this, you can hire an e-wallet mobile app development company and take consultation from their team.

Machine Learning-Powered EWallets

Just like Artificial Intelligence, Machine Learning, otherwise known as ML, is also the most crucial part of advanced technological innovation. The ML technology helps users prevent cyber frauds and crimes.

One of the best parts of including Machine Learning into the e-wallet app is that it helps businesses or users detect any cyber threat before it occurs as a crime.

Social Shopping

Another future trend of the e-wallet applications is social shopping, wherein, people are given the facility to make purchasing via social media channels and make payments without leaving the platform.

Social channels like Facebook, Instagram, Youtube, etc. attract a large audience. Targeting customers and selling them products or services directly over these platforms will be quite impactful.

It has been seen that social media users use e-wallets that are linked to their social accounts. Such integration will prove highly time saving and efficient.

Challenges in Launching an eWallet App

Are you wondering about the top challenges faced by e-wallet development companies? You are thinking about the right thing. Developing a fintech application is a tricky and daunting task where you need a team of experienced mobile app developers who can tackle all the challenges without wasting time, money, and resources.

Before you begin with e-wallet mobile app development, make sure you understand the challenges that might come during or before the development starts.

Selection of the Right Technology

The first challenge that comes while developing an e-wallet mobile app is the selection of the right set of technology. Selecting the technology which is secure and reliable is pivotal. Hire a mobile app development company that has a good understanding of technologies. Check their background, previous works, etc. and analyze their credibility.

Regulatory Compliance

When it comes to the app that includes monetary transactions, having regulations and compliance becomes evident. The central banks are very strict with such apps.

An eWallet mobile must be compliant with the rule and regulations, and only then it will be allowed to launch. If your jurisdiction does not allow certain features then you won’t be able to those features through your e-wallet.

Fraud & Scams

Another challenge that comes while building an e-wallet mobile app is the fear of fraud and cyber scams. It is a prominent & severe reason that many people still fear using e-wallet mobile apps. Many prospects still take contactless payment methods or digital payment as a risky task.

But if you build an eWallet mobile app through a certified team of mobile app developers, you can eliminate the unknown risks, fraud, data leakage, hacking, and other e-wallet vulnerabilities.

Make sure, the e-wallet app development company you hire make the product EU-GDPR complaint. It will be easy to win the trust of users globally.

Best Practices for Digital Wallet Development

eWallet mobile apps or digital wallet apps comes majorly in three types of category, closed eWallets apps, semi-closed e-wallet apps, and open wallets mobile apps.

Building each type of app has its own approach. Below are mentioned the best factors to keep in mind while developing eWallet app solutions.

Strengthen the Basics

The basic function of the eWallet mobile app is to streamline monetary transactions. So, make sure it performs its basic function without any glitches. Make sure all the basic features are properly integrated.

The success of an eWallet mobile app depends on how its basic functionality works. It will help elevate customer satisfaction.

Security

For a fintech app, it is evident to have sturdy security. In its absence, an e-wallet app just loses its meaning. For the success of the eWallet mobile app, it is essential to have strong security measures. It will also increase trust among users towards the brand.

If you are going for eWallet app development, it becomes your primary responsibility to deliver strong data security to users by leveraging the state of the art technology.

Digital Receipt

Including a digital receipt is another best practice to follow while you opt for e-wallet app development services. Allow your users to have confirmation about every transaction that they make through the digital receipt feature.

No matter how big or small is the transaction amount, for every transaction customer has to receive a digital receipt.

It is essential as it will improve customers trust in your app.

Bonus Points

Everyone wants to be rewarded for the work they do. Why transaction through the digital wallet is no exception. Give your users reward points or bonuses for every transaction.

Such points will improve the interaction of users with the app and also the app’s credibility. Make sure that the functionality of redeeming reward points work properly.

Conclusion

There is no doubt that digital wallets are the future. Digital wallets are here to stay for a long time and so is e-wallet app development.

We hope this blog post will help you understand the micros of the eWallet app development services. Before you hire an e-wallet app developer or partner, make sure you are aware of all the tics and tacs of digital wallet development.

The article is very useful, and I appreciate how you have explained everything in this Article.

The article is very useful, and I appreciate how you have explained everything in this Article, all of the features you mentioned are very important.